GET THB LOAN

USING YOUR CRYPTO

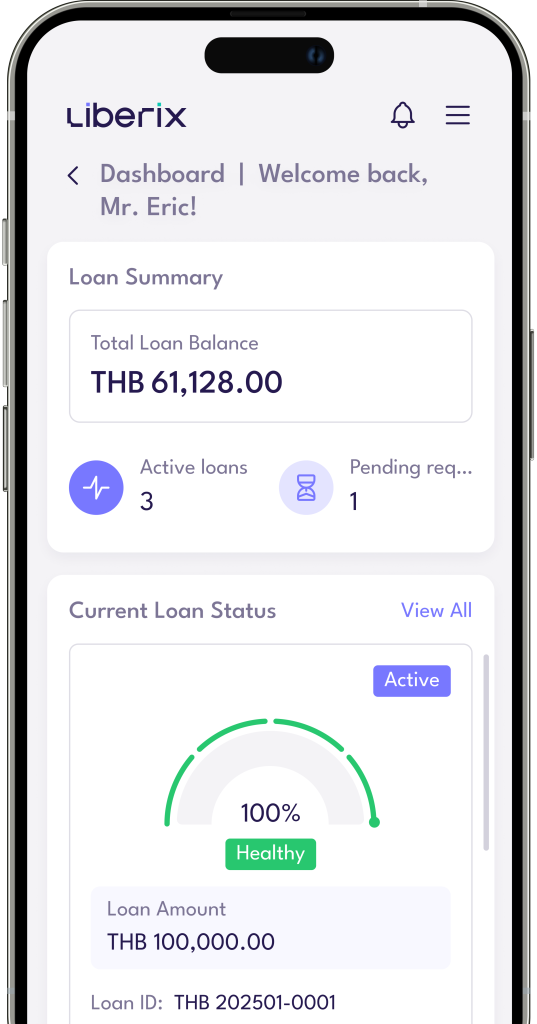

Liberix Offers Thai Baht Loans

Backed by Your Cryptocurrency

Securely stored, fully compliant, and always in your control. Receive thb directly your bank account

Put Your HODL Crypto to Work

Put Your HODL Crypto to Work

Borrow THB with your crypto

Use your crypto as collateral to get THB for whatever you need

Controllable Loan Terms

Flexible loan sizes. Choose the loan amount that fits your needs, big or small.

Simple Application

1 ID Card. No credit check. Fast approval. Receive THB within a day.

Feel Confident and Stay Secure

Your crypto is securely held with Kryptodian, our licensed custodian partner trusted by institutions.

Planning Something Important and Don’t Want to Sell Your Crypto?

Get THB loan with your crypto.

Large Credit Card Bills

Access upfront cash to manage large payments or credit card balances to avoid overwhelming interests. Stay in control while keeping your crypto intact.

Major Life Events

Funds important milestones: weddings, celebrations, or new beginnings , without cashing out your assets.

House Renovation

Renovate your home without dipping into your savings. Get longer loan terms and secure storage for your crypto collateral.

Trip of a Lifetime

Book the trip you've always wanted; flights, hotels, experiences, while your crypto stays protected.

01

02

03

04

Get to Know Our Services

Get to KnowOur Services

Competitive Rates:

Interest as low as 1% per month

Your Crypto, Your Choice:

Pledge the assets you prefer

Flexible Loan Amounts:

Borrow up to 50% of your crypto's value

Custom Loan Terms:

choose a duration from 2 weeks to 1 year

Feel Confident and Stay Secure

Your assets are securely stored with the Hong Kong-licensed custodian partner, and our operations strictly adhere to Thai regulations for complete compliance Your crypto assets are securely stored with Kryptodian, our licensed custodian partner in Hong Kong. Liberix adheres strictly to Thai regulatory standards; ensuring maximum protection and peace of mind for your funds.

See How Liberix Enable People’s Lives

Join our growing community of satisfied users. Discover how Liberix has transformed their financial journeys.

"This app has revolutionized my financial management! I love how secure and easy it is to use."

"As a business owner, I need to make frequent transactions. Liberix has streamlined my finances, saving me time and money."

"The budgeting tools are a game-changer. I feel more in control of my finances than ever before."

"I wanted to renovate my house but didn’t have enough cash, and I didn’t want to sell my crypto at that time. Then I found Liberix—used my crypto as collateral and got the loan I needed. Renovation’s done, and my crypto’s still intact."

"Something I really wanted went on a huge sale, but I didn’t have the cash to buy it. My saving is in crypto. So I decided to try Liberix and got the funds easily. Got to buy what I want —and kept my crypto too!"

"At first, I was honestly a bit worried. There are so many lending out there. But after doing some research, I felt comfortable giving it a try. Turns out it was way easier than I thought, and the approval was super quick."

"I couldn’t get a bank loan and was super stressed because I really needed a lump sum. Liberix honestly saved me. I don’t have a credit history, but I had crypto—and that was enough."

"Had an unexpected expense and all my money was tied up in crypto, and selling it that time would've meant taking a loss. I found Liberix just in time. I was able to borrow THB. The whole process was super smooth too."

Frequently Asked Questions

Only your Thai ID card and basic personal information are required during the application process

Any Thai citizen aged 20 or older holding cryptocurrency in their wallet can apply

We'll liquidate only the necessary portion of your crypto assets to cover the loan. After deducting the loan amount, interest, and appliable fees, any remaining collateral will be returned to your wallet. We'll keep you informed and support you through the process

You'll be notified if your collateral's value significantly decreases and reaches the margin level. At this point, you can top up your collateral to restore a healthy loan-to-value (LTV) ratio. If the value continues to drop and reaches the liquidation level, we'll carefully liquidate only what's needed to cover the loan, interest, and applicable fees. Any remaining balance will be promptly returned to your wallet. We'll guide you clearly throughout the entire process.

Your cryptocurrency collateral is securely stored with our trusted custodian partner, Kryptodian, licensed in Hong Kong. Kryptodian uses advanced Multi-Party Computation (MPC) technology, providing an exceptional security level, surpassing even traditional cold wallets.

Your crypto assets are securely kept with our licensed custodian partner. You can borrow funds up to 50% of your collateral's market value at the time of your loan application. Once the loan matures and repayment is complete, your crypto assets are returned to you promptly and securely.